Is This the Year You Are Ready to Move-up?

When you bought your first ‘starter’ home, you probably made choices to compromise on size or location – few people get to move into their dream home on the first go-around. We dip our toe in the sand and work toward the goal of owning a larger home with better features one day.

At current mortgage interest rates, the monthly cost of the typical new mortgage makes housing more affordable than it has ever been.

For people that have built equity in their starter homes and with mortgage rates in the lowest range they’ve been in for almost 30 years, now is the best opportunity to move up. If the rate of borrowing is better than what you paid for your first mortgage, you may discover that your carrying charges will not be much larger than what you’ve been used to paying.

You’ve spent years thinking about the next home you will live in and driving through neighbourhoods that appeal to you. Is this the year to move up?

Move-up homes offer growing families the space to live. They offer extra bedrooms for guests, children or a home office. Larger bathrooms. Ensuites. Walk-in closets. Media rooms. Recreation space for a pool table. Higher quality finishes and architectural design. Space for an outdoor hot tub. A double garage. They offer ample storage for everything and a greater variety of amenities over starter homes.

Beautiful landscaping is another advantage of move-up homes, as well as space to breathe, distance between you and your neighbours.

To get the best price when you sell your current home, make sure you make necessary improvements prior to listing. A house that is does not require immediate repair work is always more appealing to buyers. Most repairs you can make won’t be very expensive, however, you will typically see a large return on this investment in your selling price. If you lack the cash, an equity loan that can be repaid upon closing might be an plan that will work to your advantage.

Talk to a real estate agent and review the options to find out what makes the best sense for you. There is no one-size-fits-all answer. Your decision will need to take into consideration your personal financial situation combined with the current market conditions in your neighbourhood. Your realtor should be able to estimate your net equity after the sale of your home, factoring in all the costs involved.

Pre-approval is a smart move to make sure you are completely informed on how much you can afford to bid on a home. Note that pre-qualification refers to the lender telling you how much you can afford; pre-approval means they’ve actually secured that financing for you. Make sure you get pre-approved for your mortgage early in the house-hunting process, as you won’t be able to make an offer without this.

Additionally, in a bidding war a buyer with a pre-approved mortgage is more desirable than one without, and could even be viewed more favourably than a higher offer that’s contingent on financing.

If you commit to a purchase deadline for your next home, you will sacrifice bargaining power in the sale of your current home. With a deadline to sell approaching, you might find yourself in a position where you have to accept an offer below market value for your home to avoid carrying two mortgages at the same time. Consider instead that if you receive an excellent offer on your current home you can include a clause in the contract which allows you time to find a new home.

If you are not interested in selling first before making an offer on a home, or would like to keep your options open, choose a realty firm that has a “Guaranteed Sale ‘Trade Up’ Program” that guarantees the sale of your current property before you move into your new home. This situation is ideal if you have found the perfect home for your next move but have not yet sold your current property. With this program, your realtor will buy your current home themselves so you are free to pursue the purchase of your dream home.

The transactions of selling your current home and buying your next can be complex to manage as they will be happening in tandem. Two sets of mortgages, appraisals, and inspections must be conducted while two sets of mortgage experts, appraisers, lawyers, loan officers, title company reps, and inspectors are involved. Make sure you have a good team of professionals to rely on for support.

In the long term strategy, your second home will not likely be your ultimate dream home. As with your starter home, it is just a step forward. And as with your starter home, as a very general rule and depending on the amenities in the neighbourhoods you are looking in, you can expect to find that the housing options increase in size and features as you move toward the outskirts of the city.

Now it’s time to start thinking about the costs associated with your move. The first step is to create a “move-up house” budget. Consider, for example, the additional costs for utilities, gas and automobile maintenance if your commute to work will be significantly longer, maintenance costs on your new, larger home and yard, and costs for upkeep on that hot tub if it is on your wish list. Be as thorough and realistic as possible.

Before you buy a bigger house, live with the expenses for six months: allocate your money accordingly. This exercise will drive home the impact of dealing with these higher expenses each month.

Once you’ve taken an in-depth look at the costs of moving up and found it is feasible to manage this, you are now ready to move. If you’ve planned well, your future may find you sitting next to a fireplace on cool evenings and relaxing on the deck in your big backyard during summer months!

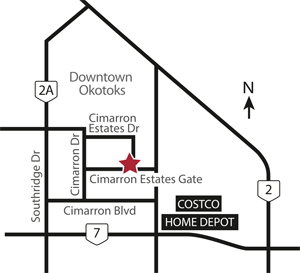

When searching for best value, consider the Cimarron move-up homes in Okotoks, a community close enough to Calgary that you can make the commute without difficulty, where you will be able to stretch your move-up options and provide your family with an outstanding place to live. Cimarron is a young and vibrant community located on the Sheep River Valley, an environmental reserve which winds through the community.

|

||

|

|

Stay Connected |

| 403.640.0708 | ||