Things to Consider So You Get a Good Start on Your Starter Home

The experience of buying a home for the first time is filled with a heady mix of drama and trauma. At the outset, many first time home buyers expect to open the doors to their dream house and triumphantly walking into their ever-after, raise-the-family home. They have visions of schools and dogs and graduations and weddings in the backyard, trading the tire swing for a hot tub and preparing for retirement. This expectation is simply not realistic. The best strategy for entering the home market is to plan to start small, and then move up in stages as you build home equity.

Every real estate investment invites a wealth of concerns, whether you are choosing a starter home, moving up or scaling down for retirement, not to mention the universal fear shared by all prospective buyers of sinking savings into the wrong property. The experience can be stressful, especially if you don’t have the a lot of resources.

Starter homes allow the individual or young family to get off to on the right foot without excessive pressure, hopefully leaving room for them to retain some financial flexibility. There is no great advantage gained in rushing forward too fast and compromising overall quality of lifestyle – we’ve all heard stories of people that are ‘house poor.’ When the mortgage loan is at the top of your borrowing ability, it is likely you will not be building any equity in the first few years of your housing payments since your payments will mostly go towards the interest cost.

The choice to invest in an affordable starter home also means that you can enter the market with a smaller downpayment, as opposed to paying rent longer while you save for that dream home. In addition to the advantage of having a much smaller home mortgage, prospective buyers can have a prudent start in their education to understand the home purchase and ownership process.

If you are looking for a starter home in the downtown core, you will probably find that apartment-style condos are the best options available. As a very general rule and depending on the amenities in the neighbourhoods you are looking in, you can expect to find that the housing options increase in size and features as you move toward the outskirts of the city.

It is important to note that starter homes will be found in a variety neighbourhoods, although you will find a larger selection of affordable homes in older neighbourhoods or low-cost neighbourhoods. Homes in older neighbourhoods will generally require a higher level of maintenance, so if you do not have the skills necessary for this work you should proceed with a great deal of caution. If you have to subcontract work that may be needed you’ll have to be prepared to have a comfortable discretionary fund that you can easily draw on for emergencies, such as furnace repairs or water heater replacements.

In any case it is always advisable to have a competent, qualified home inspector review the home before you purchase, but this is especially recommended when buying an older home.

The desire for a new single-family home on a previously unused lot is still achievable, but it in larger cities it is generally necessary to move to urbanized areas outside the city’s boundaries to capture the lowest cost land. The only downside of this is the longer commute to work, but if you think of this purchase as a single step in a move-up strategy, this compromise can be short-term.

When it comes to making a decision to build affordable housing, factors that influence developers include land prices, perceived value, market demand, city planning laws, construction costs, and profitability. Many cities have taken steps to favour master planned communities where large tracts of land are set aside for one complete build-out in order to maintain low costs to the developer and provide essential affordable and entry-level housing.

The actual cost of owning a home is not reflected in the purchase cost. There are property taxes, maintenance and repairs, homeowner association fees–many things to consider. Make sure you include these costs into your calculations when weighing the factors for and against buying a home.

Canada Mortgage and Housing Corporation Mortgage Loan Insurance enables you to finance up to 95% of the purchase price of a home through your lending institution. CMHC recommends that mortgage payments, property taxes and utility costs amount to a maximum of 32 per cent of a household’s gross monthly income. The total debt load—including mortgage commitments plus other loans, lines of credit or credit card payments—should not exceed 40 per cent of income.

Note that pre-qualification refers to the lender telling you how much you can afford; pre-approval means they’ve actually secured that financing for you. Be sure to get pre-approved for your mortgage early in the house-hunting process, as you won’t be able to make an offer without this.

There are a lot of advantages for first-time buyers who buy a home that is more affordable. Before making a commitment to a home loan, consult a financial professional and do your own research to see if the budget and timing work well to help you meet your end goals.

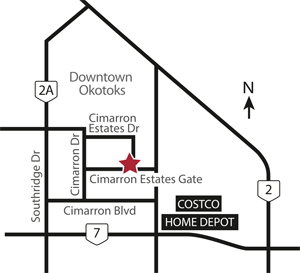

A prime location to begin your search for the perfect starter home is the Cimarron development in Okotoks, a community just south of Calgary. In this beautiful neighbourhood that includes homes for moderate income owners and luxury estate homes, you will also find a selection of condos and single family homes at affordable prices that favour people buying homes for the first time.

Developed as a family-friendly community, Cimarron is the perfect choice for people seeking the best of everthing. Here you’ll find a relaxing, contemporary environment in homes bordering on a river valley, and access to a range of convenient amenities. Cimarron represents the best of what Okotoks’ family-orientated neighbourhoods can offer.

|

||

|

|

Stay Connected |

| 403.640.0708 | ||